Honda, Nissan and Mitsubishi suddenly merged.

(Image from bean bag AI prompt: three people embrace together)

Nissan, Honda and other giants are brewing and reorganizing, and the competition pattern of the automobile industry is ushered in a major reshuffle?

On Wednesday, it was reported that Honda Motor Co. and Nissan Motor Co. are preparing to start negotiations on a possible merger, and the two companies also plan to eventually bring Mitsubishi Motors into the holding company. At present, Nissan is the largest shareholder of Mitsubishi Motors, holding 24% of the shares.

The reason behind the merger is not difficult to understand. With the intensification of competition in the global automobile market, the transformation of electric vehicles has brought challenges. Oil vehicles, hybrid vehicles and pure electric vehicles all need billions of dollars of investment capital, and the scale and cost are very important.

At present, Nissan is in deep financial difficulties, with only 12 to 14 months of cash reserves. Honda’s financial situation has also declined, and its performance and delivery guidelines have been lowered again.

This potential merger will create a holding company including Honda, Nissan and Mitsubishi Motors, which will be the biggest reorganization of the automobile industry since the establishment of Stellantis Group in 2021. After the merger, the annual sales of the three car companies are expected to exceed 8 million, which is enough to challenge the global giants Toyota (11.2 million in 2023) and Volkswagen (9.2 million last year).

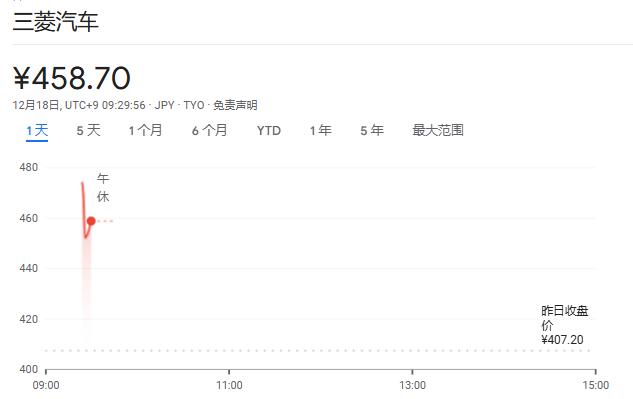

After the news of the merger came out, Japanese stocks came to the market on Wednesday, and the increase of Mitsubishi Motors once expanded to 17%. Nissan shares have not yet started trading, and the bidding price has touched the upper limit of intraday trading. Honda’s share price once fell by 2%. Nissan’s share price rose sharply overnight, Nissan’s American Depositary Receipts rose by 11.5% to close at $5.10, and Honda’s share price also rose slightly by 1% to close at $25.26.

Nissan is in deep financial difficulties, and Honda lowered its delivery guidelines.

At present, Nissan’s situation is even more difficult. Earlier this year, Nissan reported that its operating profit in the North American market fell by 99%. The main problems facing Nissan come from:

Rising car prices: high prices lead buyers to turn to competitors.

Decline in reliability: consumers’ trust in key models is reduced.

Fierce competition: Toyota, Hyundai and Kia continue to dominate Nissan’s market segments.

What is even more worrying is that it is reported that Nissan has only 12 to 14 months of cash reserves. The company also faces the pressure of radical shareholders and huge debt burden, which leads to the credit market questioning its investment grade rating. In order to maintain its operation, Nissan has greatly increased its promotion efforts, including providing 0% annual interest rate financing and low-cost leasing for popular models such as Rogue, Altima and Pathfinder. It is expected that this trend will continue until 2025.

Honda lowered its performance guidance again, and now it expects the net profit to drop even more, raising its previous 9.7% downward guidance to 14%. Previously, the sales volume was expected to be 3.9 million vehicles this fiscal year, but now the guidance is lowered to 3.8 million vehicles. In the first half of the year, the Group’s automobile sales decreased by 8% to 1.78 million vehicles. In the six months ended September 30, Honda’s revenue increased by 12%, but it was lower than market expectations.

Nissan’s share price has fallen by about 39% so far this year, and its market value is about $8 billion. Honda’s share price fell by about 18%, and its market value was about 40 billion US dollars.

The global automobile competition pattern fluctuates

In addition, as a partner of Nissan, Mitsubishi Motors is likely to participate in this merger. It is worth mentioning that Nissan holds 34% of Mitsubishi Motors. As part of the emergency measures to turn losses into profits, Nissan plans to reduce its shareholding ratio to 24%.

According to the analysis, as a partner of Nissan, Mitsubishi has a competitive advantage in the Southeast Asian market and has advanced plug-in hybrid technology. Mitsubishi has previously said, "We are exploring all possibilities and are eager to cooperate in areas where we can give full play to our advantages."

According to the analysis, the transaction will give birth to the competitors of Toyota Motor Corporation, thus integrating the Japanese auto industry into two camps. After reducing the long-term global partnership with other automakers (Nissan cooperates with French Renault and Honda cooperates with General Motors), it will also provide Honda and Nissan with more resources to compete with larger peers.

According to media analysis, the merger will help the two manufacturers compete with electric vehicle competitors such as Tesla and China, which will also put them in a better position to compete with Toyota, the world’s largest automaker, at home and abroad.

Toyota has invested in Subaru, Suzuki Motor Company and Mazda Motor Company, and built a powerful brand group with its first-class credit rating. In the first six months of this year, Honda, Nissan and Mitsubishi together sold about 4 million cars around the world, far below Toyota’s own sales of 5.2 million cars.

Original title: "Honda, Nissan, Mitsubishi sudden exposure merger"

Read the original text